One of the hottest growth sectors in the financial services sector in Australia over the past decade has been the growth in Self-Managed Superannuation Funds (SMSFs).

So what is causing this tremendous growth in people’s desire to “run their own fund”?

So what is causing this tremendous growth in people’s desire to “run their own fund”?

For too long people have felt detached from what is usually their second largest asset after their family home.

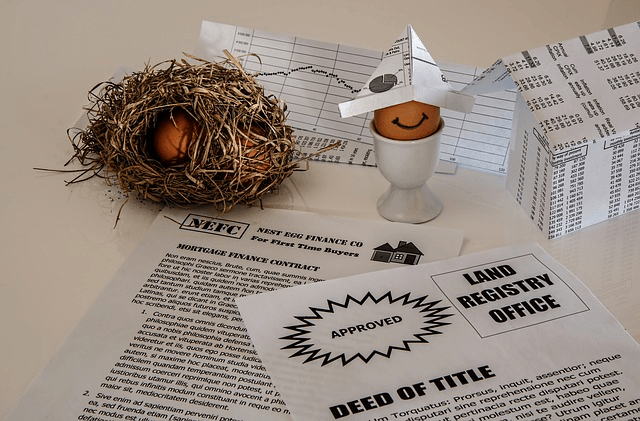

The good news is that by establishing a SMSF you can regain some control over your money. In particular, you can control how your money is invested. Directly owned residential or commercial properties can help give you take control

If you are a business owner current SMSF legislation will even allow the purchase of business premises for your company to rent with the rent being paid to the SMSF. AM

The good news is that by establishing your own SMSF you can regain some control over your money. In particular you can take control of how your money is invested

The ability to leverage in the SMSF to purchase assets such as property, can have major benefits especially when coupled with the favourable taxation situation

A SMSF helps you get far more involved with your future retirement nest egg and enables you to have more control of your financial future